Thrift Value Of Donated Items 2025. But once we’ve received a donation, what we do with it determines how. By knowing the rules and how to calculate the fair market value (fmv) of your donated items, you can potentially reduce your tax bill and maximize the benefits of your.

If you itemize deductions on your federal tax return (using the long form), you are entitled to claim a charitable deduction for your donation to goodwill. But once we’ve received a donation, what we do with it determines how.

Irs Clothing Donation Value Guide 2025 Issie Leticia, For those planning to make charitable contributions in 2025, understanding these documentation requirements is essential to ensure compliance and maximize tax deductions.

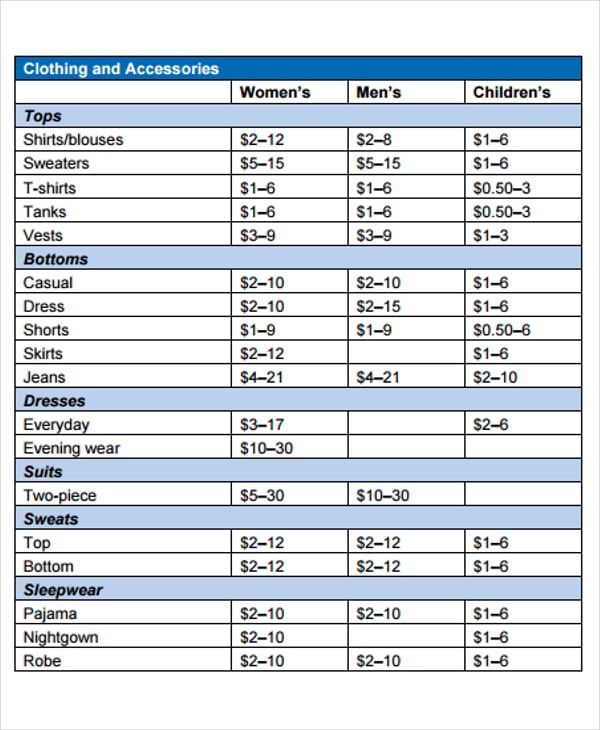

Salvation Army Donation Guide Printable, Get started with our donation valuation guide , which features estimates for the most commonly donated items.

Six Ways Your Thrift Donations Help, Onney crawley of goodwill industries international exclusively tells green matters via email why her.

Get Our Example of Thrift Store Donation Receipt Template Goodwill, To get started, download the goodwill donation valuation guide, which features estimates for.

What Donated Items Do Thrift Stores Throw Out?, Every time you shop goodwillfinds, you provide jobs and training in your community, give goods a second life and make sustainable choices for the planet.

My First Thrift Haul of 2025 l Average Cost of Goods 3.02 YouTube, Here's a guide to check the values.

Explore Our Example of Thrift Store Donation Receipt Template Receipt, According to the irs, you can deduct the fair market value — the price a buyer would be willing to pay for them — of the clothing, household items, used furniture, books, etc.